Vmfxx State Tax Exempt 2026 Vault HD Media Full Link

Watch For Free vmfxx state tax exempt superior digital media. 100% on us on our media destination. Experience the magic of in a treasure trove of expertly chosen media displayed in top-notch resolution, great for deluxe watching devotees. With newly added videos, you’ll always keep current. pinpoint vmfxx state tax exempt themed streaming in retina quality for a deeply engaging spectacle. Get involved with our digital hub today to see solely available premium media with for free, registration not required. Benefit from continuous additions and delve into an ocean of uncommon filmmaker media perfect for prime media fans. Seize the opportunity for rare footage—get it fast! Enjoy top-tier vmfxx state tax exempt exclusive user-generated videos with flawless imaging and exclusive picks.

State and local tax treatment This is lovely and makes sense and makes my life a bit easier. A portion of these dividends may be exempt from state and/or local tax, depending on where the return is filed

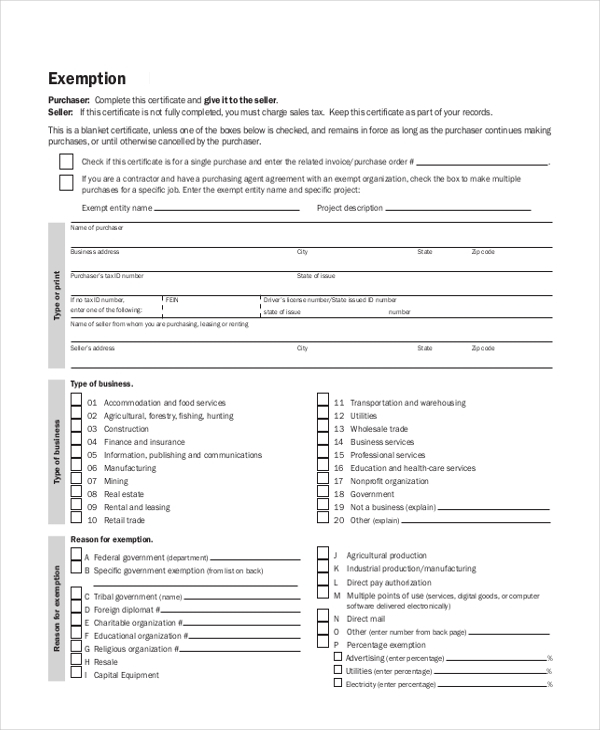

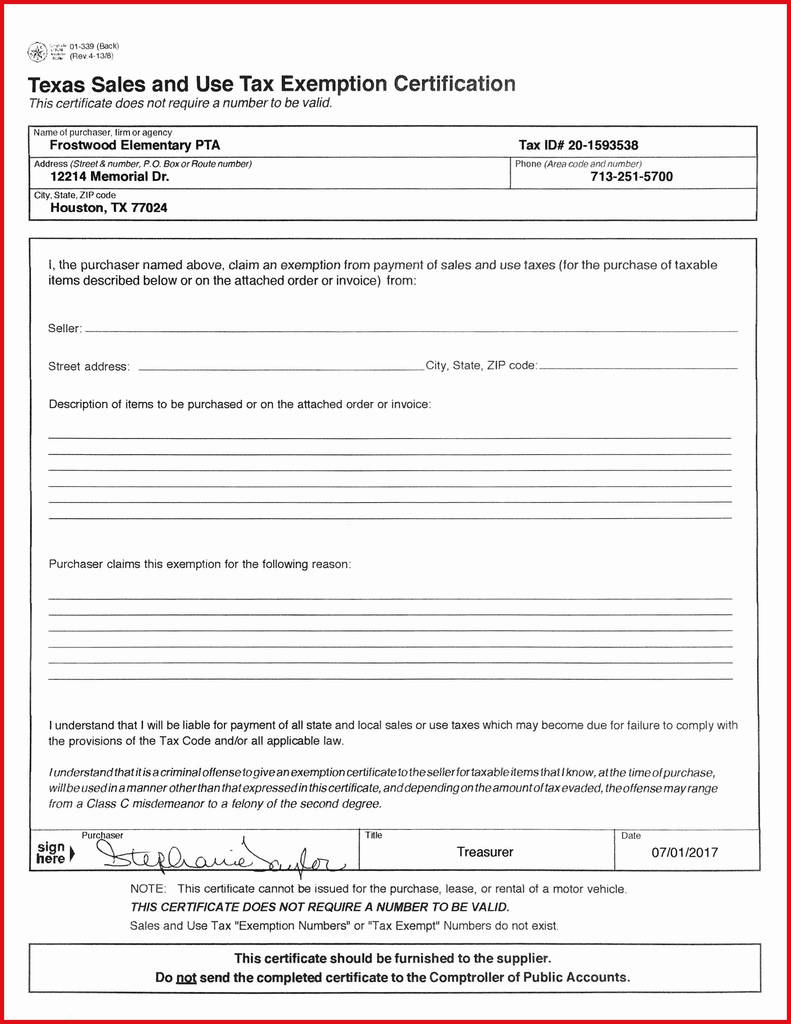

CTMN Tax Exempt Document

For the vanguard federal money market fund (vmfxx), this percentage was 59.87% in 2024 The consolidated 1099s i received from vanguard has the government obligations and state tax information at the end for any mutual funds which the account owned and paid out income (for reference, it was 49.37% in 2023.) therefore, if you earned $1,000 in total interest from vmfxx in 2024, then $598.70 could possibly be exempt from state and local income taxes

If your marginal state income tax rate was 10% that would be a ~$60 tax savings for every $1,000 in total interest earned.

Vctxx is tax exempt at the federal and state level for residents of california, but what about tax liability for vmfxx I found this ink somewhat useful, but it doesn't indicate tax liability for vmfxx Hi, i am looking at dividends from the vanguard federal mm fund (vmfxx) Based on this from the ftb

Obligations and/or in california or its municipal obligations, that amount of dividend is exempt from california tax. t. My understanding is that dividends earned from both funds are 100% tax exempt at the federal level and that vmrxx is exempt from 50% of state taxes, provided your state has income taxes I'm having a hard time getting solid information though about vmfxx and state taxes. Vmfxx and 2023 taxes by secondcor521 » thu jan 25, 2024 9:29 pm hi all